michigan property tax rates 2020

The 2018 average property tax bill in Michigan was about 2400. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

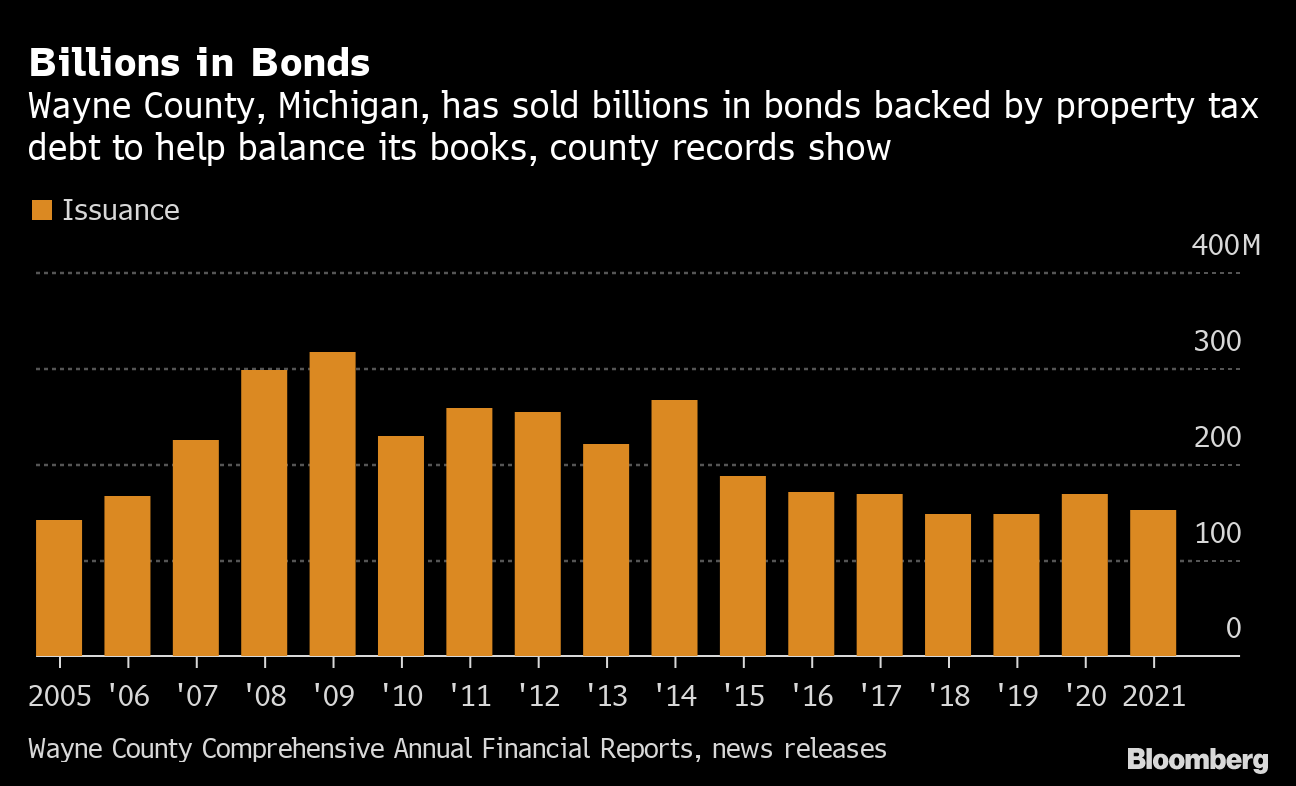

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

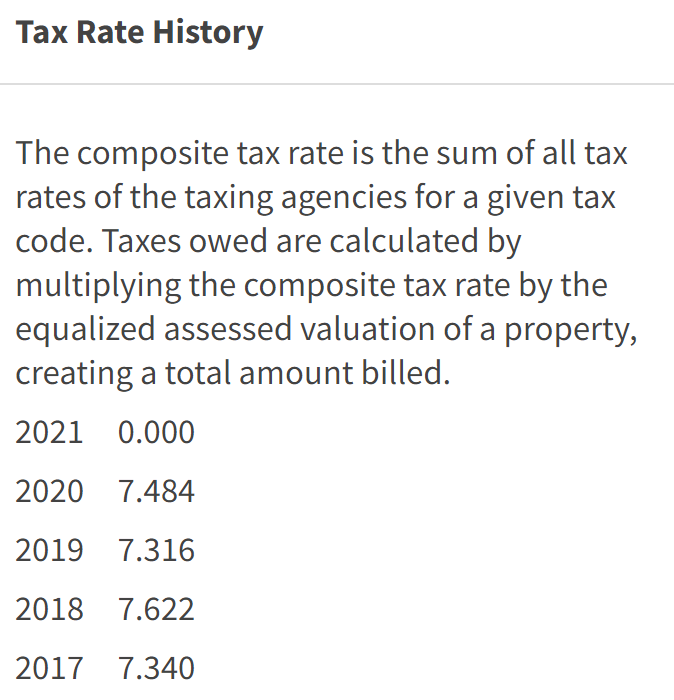

Tax rates in Michigan apply to your propertys taxable value.

. Ad Enter Any Address Receive a Comprehensive Property Report. Discover the Registered Owner Estimated Land Value Mortgage Information. The majority of local governments had higher tax rates in 2020 than they did in 2004.

Follow this link for information regarding the collection of. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the. On February 15 2023 penalty of 3 will be added.

2020 Tax Rates Popular. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. Plymouth Township Tax Rates Homestead Property Only.

There are also jurisdictions that collect local income taxes. Published on 05 August 2020 Modified on 23 December 2020 By. The IRS will start accepting eFiled tax returns in January 2020.

See Results in Minutes. Beginning March 1 2023 all unpaid taxes are considered delinquent and are payable with additional penalties to Oakland County. Michigan ranks 13th in the country in terms of property taxes in 2020 with an effective property tax rate of 144 percent the highest was New Jersey at 221 percent the.

2020 Michigan County Allocated Tax Rates. Michigan has a flat income tax of 425 All earnings are taxed at the same rate regardless of total income level. Uncover Available Property Tax Data By Searching Any Address.

TAXES ARE PAID IN ADVANCE. 84 rows When comparing Michigan real property tax rates its helpful to review effective tax rates which is the annual amount paid as a percentage of the home value. When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. The state government levies a statewide tax of six mills and additional rates are set by local government tax authorities such. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465.

Michigan has a flat 425 percent individual income tax rate. The Michigan county allocated tax rates are provided annually as supplemental resources for the. Mary Schulz - March 15 2021.

Summer Tax Rates. Simply enter the SEV for future owners or the. Michigan has a 600 percent corporate income tax rate.

July 1 - June 30. Tax rates increased for reasons other than just constraints on the tax base eg some local gov-. Current and previous tax rates for City of Dearborn property owners.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Are There Any States With No Property Tax In 2022 Free Investor Guide

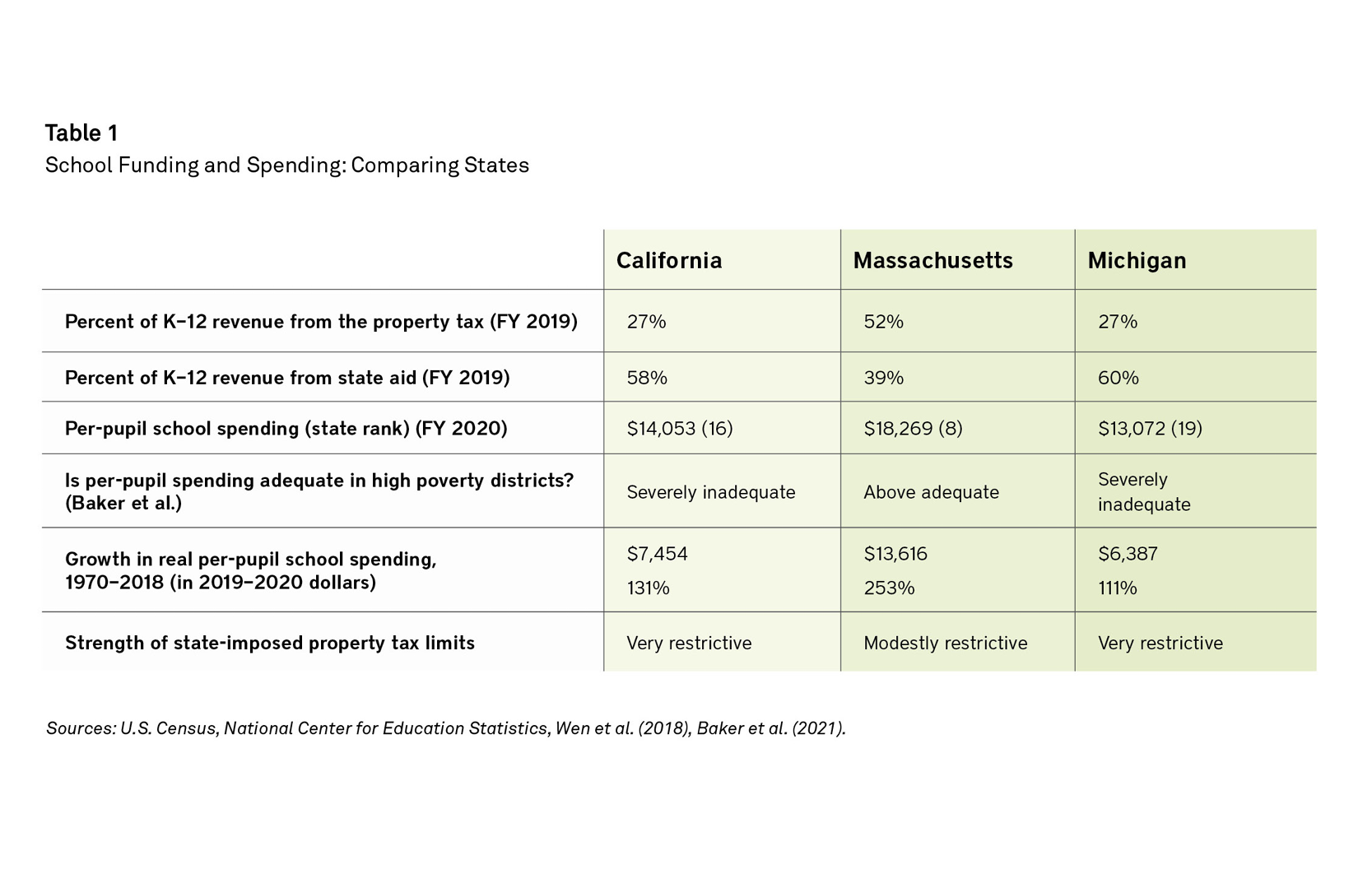

Public Schools And The Property Tax A Comparison Of Education Funding Models In Three U S States Lincoln Institute Of Land Policy

Your Guide To 2021 Tax Rates Brackets Deductions Credits

Property Tax Calculator Property Tax Guide Rethority

Tax Bill Information Macomb Mi

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Sales Taxes In The United States Wikipedia

State By State Guide To Taxes On Middle Class Families Kiplinger

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Property Taxes How Much Are They In Different States Across The Us

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

Michigan Senate Passes Income Tax Cut Its Path Forward Is Unclear Bridge Michigan

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Cook County Property Tax Portal

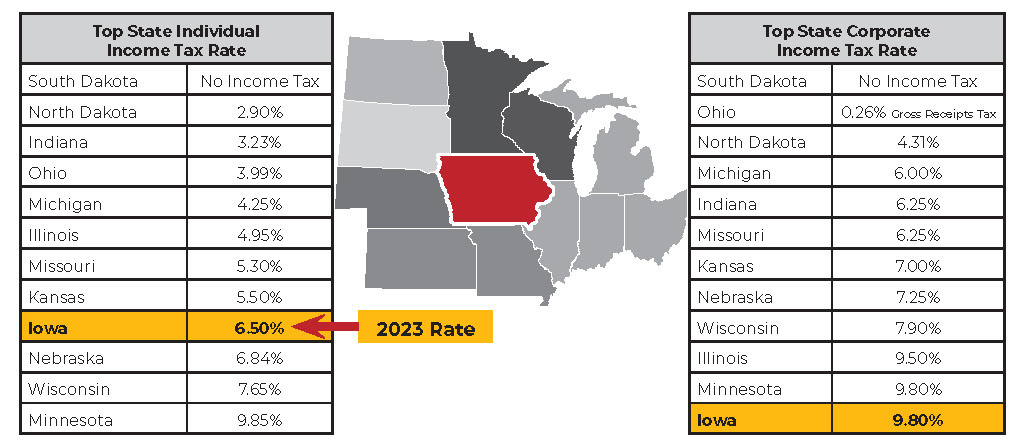

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

Property Tax Calculator Smartasset

County Of Midland Michigan Treasurer Property Tax Information